Christopher J. Larson, Wisconsin State Senator for 7th District | Facebook

Christopher J. Larson, Wisconsin State Senator for 7th District | Facebook

According to the Wisconsin State Legislature's official website, the bill was described as follows: "creating an employee ownership conversion costs tax credit, a deduction for capital gains from the transfer of a business to employee ownership, and an employee ownership education and outreach program. (FE)".

The following is our breakdown, based on the actual bill text, and may include interpretation to clarify its provisions.

In essence, this bill establishes tax incentives to assist businesses in Wisconsin converting to employee ownership structures and requires the Department of Revenue to implement a program promoting these structures. It introduces a nonrefundable income tax credit covering 70% of conversion costs, up to $100,000, for conversion to a worker-owned cooperative, and 50% for conversion to an employee stock ownership plan. An individual income tax subtraction and a corporate income and franchise tax deduction are available for capital gains from such transfers. Additionally, the bill mandates an economic development program to provide education and outreach on employee ownership, including training, technical assistance, and potentially applying for a federal grant to fund these activities. Eligible businesses can apply for certification from the department to claim these incentives. The measures apply to taxable years beginning after Dec. 31, 2024.

The bill was co-authored by Representative Shae A. Sortwell (Republican-2nd District) Senator Cory Tomczyk (Republican-29th District). It was co-sponsored by Representative Clinton M. Anderson (Democrat-45th District), Representative Ryan M. Clancy (Democrat-19th District), and Representative Angelina M. Cruz (Democrat-62nd District), along 22 other co-sponsors.

Chris Larson has co-authored another two bills since the beginning of the 2025 session, with none of them being enacted.

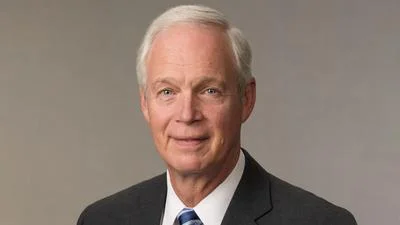

Larson graduated from the University of Wisconsin, Milwaukee in 2007 with a BA.

Larson, a Democrat, was elected to the Wisconsin State Senate in 2011 to represent the state's 7th Senate district, replacing previous state senator Jeffrey Plale.

In Wisconsin, the legislative process starts when a senator, constituent, group, or agency proposes an idea for a bill. After drafting, the bill is introduced, numbered, and referred to a committee for review and public input. If approved, it moves through three readings and votes in both the Senate and Assembly. Once both chambers pass the same version, the bill goes to the governor, who can sign it, veto it, or let it become law without a signature. Only a small share of bills introduced each session ultimately become law. You can learn more about the Wisconsin legislative process here.

| Bill Number | Date Introduced | Short Description |

|---|---|---|

| SB21 | 02/05/2025 | Creating an employee ownership conversion costs tax credit, a deduction for capital gains from the transfer of a business to employee ownership, and an employee ownership education and outreach program. (FE) |

Alerts Sign-up

Alerts Sign-up